Stocks, bonds and futures in everything from financial instruments, coffee to gold and hydrocarbons used to be traded in open-outcry exchanges – an apt name considering the organised chaos in the pits. Scenes of traders clad in bright jackets yelling bids amid a blizzard of ticker tape and order slips made for good news footage, but the business model was ill-suited to the digital age.

Market shift

As trading moved onto screens and markets turned fully digital, many of the idiosyncrasies of the paperchase were imported into the digital world and remain in place.

One drawback of the physical exchanges was scale – it was a matter of go big or go home. A small exchange specialising in a narrow range or even a single product – such as Moutai spirit in Hong Kong – would not be possible with the physical model.

A supermarket or e-commerce site might not seem to be an exchange, but that’s exactly what it is – customers exchange money for items, with the shop acting as broker between customers and producers or wholesalers. But in shops, pricing power belongs with the supplier; there is little or no barter.

Helping to set up exchanges of all shapes and sizes, Israel-based start-up Exberry recently powered ProMEX to launch its first Hong Kong exchange solution, which offers trading in Moutai as a first warehouse held commodity.

“The evolution and maturing of markets like ProMEX, where the market participants, or ‘shoppers’ if you like, actively set the price by selling and buying, is something that is spreading through the world of marketplaces,” said Magnus Almqvist, Head of Exchange Development at Exberry. “You see it in fashion items, limited-edition items and so on – the general public is getting used to being active in the price-setting and people want the ability to sell items they have bought.”

Dynamic region

Mr Almqvist explained that East Asia is a dynamic and fast-moving region and Exberry has a very healthy pipeline of prospects that will drive its expansion.

The Exberry range of products lets existing traditional capital markets players and new exchanges and marketplaces quickly launch to trade more or less any asset – whether deliverable commodities via exchange-traded products and digital securities, “or a brand-new asset that only you can imagine,” Mr Almqvist said.

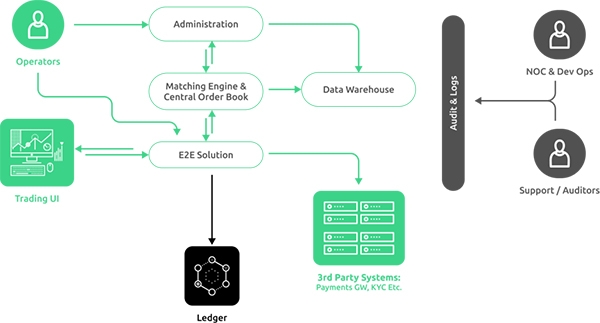

The Exberry software as a service (SaaS) solution has matching and price-discovery capabilities. The firm uses distributed ledger blockchain technology to rapidly launch end to end solutions that can even include all the functions of a traditional exchange, such as clearing and real time risk.

Fast-track evolution

The world is witnessing rapid advances in fintech along with the appearance of novel technologies such as non-fungible tokens (NFTs) and blockchain currency, a virtual version of an evolutionary explosion. Mr Almqvist said Exberry was well placed to serve this new financial world.

“This is exactly what makes life in Exberry so exciting! The evolutionary explosion we see right now is amazing and Exberry is perfectly placed to support and enable the new marketplaces and new initiatives we see around the globe today,” he said.

Consumers worried about food inflation might be interested in agricultural futures, at present limited to big operators. Mr Almqvist said one obstacle with commodity futures markets is that investors need to put up substantial collateral to make deals, but it might be possible to tokenise futures and engage in fractional trading to enable more people to get involved.